Hyperbitcoinization, Soon?

Why models are futile and the world may be closer to a Bitcoin Standard than many expect.

I think it is credible that we are going to be living on a Bitcoin Standard much sooner than many expect, even die hard Bitcoiners. Explaining why I find a more truncated timeline at least plausible will be the focus of this article. While I don’t have a specific prediction (at least that I am willing to share), I don’t agree with the relatively common view that some form of hyperbitcoinization is many decades away.

***USUAL CAVEATS APPLY - take this with a grain of salt. Anybody predicting the future is a charlatan, me included. I’m presenting some honest thoughts, while acknowledging that I can’t possibly determine how this will all play out. While I usually try to mute the bullishness somewhat, I’ll loosen the reigns for today, just for the heck of it.***

You have probably seen some charts which attempt to plot Bitcoin’s growth into the future. Some of these extrapolate past performance, some overlay adoption curves of previous technologies, and others use known quantities such as supply issuance to model what Bitcoin eating the world might look like, and over what time period it might happen.

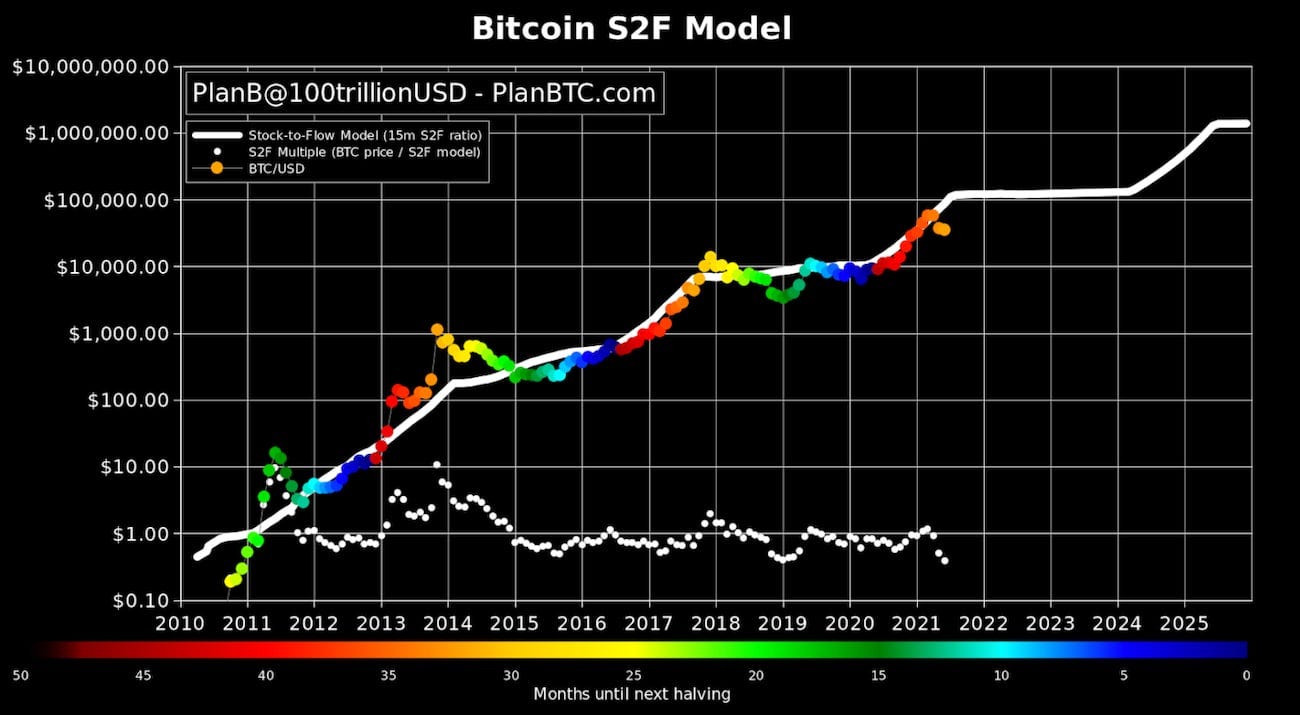

It is all more or less nonsense. I say more or less, because each model or prediction usually contains some information that provides a helpful generalisation about the world which can be worth understanding. The model above - Stock to Flow (not to be confused with the underlying concept, which is merely descriptive) - has been particularly controversial in the Bitcoin Community. Its creator - PlanB - likes to say that ‘all models are wrong, some are useful’. While there is a certain truth to this, I am of the view that there is no useful or accurate way to model Bitcoin’s adoption into the future.

Stock to flow won’t work, because a single variable that doesn’t account for all the factors that influence demand will not determine the trajectory; extrapolating past growth is a blind crabshoot; and comparing previous technology adoptions is also futile, given that both the technologies themselves and surrounding circumstances are not remotely comparable. The only thing that will model the various constitutent components of Bitcoin’s complex adoption path is reality itself. We will probably go up and to the right, with volatility. That is about as specific a model as we can hope for.

https://twitter.com/DylanLeClair_/status/1744431645984264317

Aside from generally throwing shade at models, there is a more specific reason that I believe the endeavour to be futile. Put simply, the most important factor in Bitcoin’s adoption trajectory is human psychology, and it would be a fool’s errand to try to predict with any sort of precision how the unprecedented growth of a sound monetary network in the digital age will be impacted by the fickle thing that is human perception, whether on an individual level or as an emergent collective.

I recently saw a clip of Saifedean Ammous explaining that Bitcoin isn’t the iPhone, but rather it’s gunpowder. The game theory means it isn’t relevant whether people want to adopt it or not, despite the fact that this may be how it currently seems. With gunpowder, it is adapt or die. Once it becomes available to anyone, you don’t really get to choose whether or not you use it. If you don’t, you’re out of business, whether figuratively or literally. A point will come, sooner or later, that feedback mechanisms from the real world will make apparent how critical for flourishing the adoption of Bitcoin is. When that point of realisation reaches the collective consciousness, all bets are off. Nobody can say where this psychological tipping point theoretically lies, and certainly not how far off in the future it is.

There will come a moment at which the shape in the clouds becomes so prounounced that a critical mass of people see the outline. While we can guess, we don’t actually know what a critical mass would look like. While this will likely be a period rather than a moment, when it occurs, we enter a singularity of sorts, beyond which any attempt to reason inductively is practically futile. Even looking at previous hyperinflations may not be instructive, given the novel existance of clear alternative to failing currencies (and assets denominated in them) in the digital age.

Bitcoin’s growth is a function of how quickly the idea spreads. But what ‘idea’, and what does it mean to spread? Does the idea, to count as being understood, have to entail a deep understanding of the benefits of sound money, or merely a vague understanding that Bitcoin represents decent savings technology? When we say spread, do people who haven’t given it much thought but are merely emulating the investment strategies of others count? Truthfully, it’s complex, and I certainly don’t know. But I believe a good way to think about it is by using bear market metrics as a rough mark for ‘the idea’. Namely, when the speculative mania tourists have departed for another season, and only relatively ‘strong hands’ remain, that indicates the level of real current adoption. These are the people who are still around when the price floor is set - whether they are deeply ideological about ‘the cause’, or merely have witnessed the cycles repeating and trust ‘the process’.

What possible framework could exist to determine what the runway for the idea’s future spread looks like? Essentially, this boils down to whether the rate of adoption will slow down, speed up, or remain constant. Given that almost everyone on the planet has heard about Bitcoin, perhaps the majority of those open minded people that are predisposed to ‘getting it’ have already been converted. Perhaps the remaining sponges won’t absorb the water in the same way and we will be fighting an uphill battle for every orange pill from here on out.

On the flipside, the state of the exising world is clearly relevant to how susceptible the population will be to a form of money that is sound and censorship resistant. But that would entail a prediction of far more complex factors, political and economic, and also a way to predict how this would link to the average human mindset. A factor that I suspect will be at least somewhat relevant is the prevelance and proportion of Bitcoin proponents in any social group. If we say that everyone has heard of Bitcoin, and every group has that one Bitcoin Dude/Gal, it is pretty easy for a group to maintain their sense of safety in numbers and their comfortable social validation. Dismissive scoffing is unremarkable. What happens when there are two in every group, or three? The last dominos logically don’t take as long to fall as the first.

Perhaps more important though is when the adoption wave reaches the average institutional investor, because these people are highly influential in how a large portion of the population store value. The Overton Window for this group, or the range of acceptable ideas, is relatively narrow, meaning that the distribution isn’t and won’t be even across Bitcoin’s adoption timeline. Until now, we have realistically seen only outliers embrace it. With the (likely) coming ETFs, it is beginning to look like those not allocated at all could soon be in the minority. What cascading psychological effect of general applicability could this have?

As with every area/phenomenon, there is an academic/thinking class. Most people simply don’t have the bandwidth to think deeply about most subjects; it would be a tremendous waste of time and energy for them to do so. The majority of Americans still think the Dollar is backed by Gold, indicating that the tipping point for a moment of monetary inversion can come without large swathes of the population even understanding what is happening. For now, the ‘thinking’ class when it comes to money and economics are still largely dismissive of Bitcoin. We have seen that they are quite happy to trot out the same intellectually shallow arguments year after year: ‘inherent value’, ‘volatility’, ‘speculation’….just typing these words gives me nausea at this stage. The point being, there will come a time when these arguments simply cannot be taken seriously any more.

Let’s just take one example - many economists and bankers would still insist that Bitcoin is a speculative mania in the same way tulips famously were. Of course this argument doesn’t logically hold water: tulips could never have constituted an evolution of money in the way that Bitcoin does. Additionally, the tulip mania bubble didn’t keep reinflating exponentionally larger in a pulse-like manner every four years. Despite this, the intellectual class aren’t yet at the point where they are ridiculed for these lazy analogies. But this point will come. These people have been objectively wrong for 15 years now. Very few phenomena come with an objective arbiter of truth, which in Bitcoin’s case is price. Is it credible to maintain your stance when you have been wrong for, say, 20 years?

Relatedly, and as pointed out recently by Lyn Alden on the What Bitcoin Did Podcast, most people outside the Bitcoin camp are not aware that Bitcoin has had three full cycles already, where there has been a correction from an approximately 90% drawdown. I wasn’t interested in Bitcoin in 2017 and don’t remember seeing a thing about it, notwithstanding having a vague notion of its existence. The 2021 cycle was more mainstream, even if somewhat masked by the Covid liquidty injections. The point is, to most people, this is something that does resemble a bubble without closer inspection. If and when Bitcoin makes another all time high, this changes. Very few won’t be curious as to why this particular cockroach just won’t die.

Anchor: “You say you did a deep dive. It only took me about 20 pages of The Bitcoin Standard to realise that this was something….”

Something that appears to me to be underweighted is the fact that so far, Bitcoin has produced only winners. By that, I mean that there are examples of people that have made spectacular amounts of money by adopting it early, but few in the real world sense that they have lost by not doing so, notwithstanding the zero sum effect, meaning that the wealth generated has usually come from somewhere. While plenty would explain that the superyachts of the early adopters were paid for by the greater fools coming behind them; how does this stack up when Bitcoin reaches an all time high and technically everyone who has ever bought is in (unrealised) profit? The answer, clearly, is that Bitcoin has successfully sucked monetary premium from other assets. The people that sold their second houses for Bitcoin have taken purchasing power not from other Bitcoin holders, but from everybody who stores value in houses. It is important to recognise that this is the more accurate (though less common) framing, and why the Bitcoin ‘bubble’ will not in fact burst as many seem to expect.

At some point along Bitcoin’s growth curve, it will become apparent what is really happening. Those that hold weaker assets are sinking. It is all one pie - and it always was. They have backed the wrong horse. Fear of loss is a greater motivator than hope of gain, and at some point, once the writing is clearly on the wall for the prospects of real estate, passive index funds, and sovereign bonds, a trickle becomes a flood, and the confident phalanx of the shields of the Dismissive Brigade breaks and they begin to rout.

Every price appreciation cycle brings not just exponentially more people, but exponentially more communicators and leaders. Right now, people can dismiss Saylor as a fringe CEO, and Bukele as the leader of a small country. But sometimes the first follower can be as important as the leader for group dynamics. If this coming cycle sees any sort of significant price appreciation, it appears highly likely that other high powered CEOs and nations will follow the recently trodden paths of the visionaries. How does that game theory play out once the writing is on the wall for everyone to see?

So what is my best guess for how all of this plays out?

Weren’t you reading? I don’t have one. But I’m prepared to be surprised.

Thanks for reading, as always.